Introduction

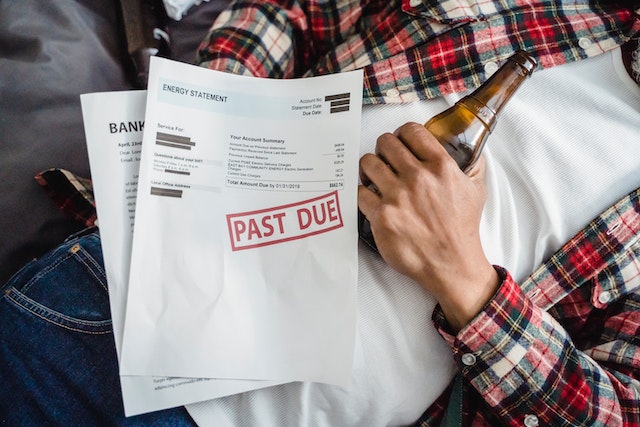

Feeling overwhelmed by debt is not only a financial burden, but it can also take a toll on your emotional well-being. The constant worry and stress can consume your thoughts and affect your relationships, leaving you feeling helpless and alone. But there is hope. Filing for bankruptcy may be a difficult decision, but it can also be the first step towards a brighter future.

In this guide, we’ll explore what happens after filing for bankruptcy, from the types of bankruptcy to the emotional effects and the road to rebuilding your credit. We understand that this is a difficult time, but we’re here to offer expert insights and practical tips to help you navigate the process and start anew.

The Bankruptcy Process

The bankruptcy process involves several steps that individuals and businesses must follow to successfully file for bankruptcy. These steps include:

Pre-Bankruptcy Credit Counseling: Before filing for bankruptcy, individuals must complete a pre-bankruptcy credit counseling course to ensure that they understand their options and alternatives to bankruptcy.

Filing for Bankruptcy: Once individuals have completed credit counseling, they can file for bankruptcy by submitting a bankruptcy petition to the court. The petition will include information about their debts, assets, income, and expenses.

Automatic Stay: Once the bankruptcy petition is filed, an automatic stay goes into effect, which stops most creditor actions, such as wage garnishments, foreclosures, and collections.

Meeting of Creditors: About a month after filing for bankruptcy, individuals must attend a meeting of creditors, also known as a 341 meeting. During this meeting, the trustee and creditors may ask questions about the bankruptcy petition and the debtor’s financial situation.

Bankruptcy Discharge: After the meeting of creditors, individuals must complete a debtor education course and wait for the court to issue a bankruptcy discharge, which eliminates most of their debts.

Potential Challenges After Filing for Bankruptcy

While bankruptcy can provide a fresh start for individuals and businesses struggling with overwhelming debt, there can be potential challenges after filing for bankruptcy, including:

Credit Score: Filing for bankruptcy can have a negative impact on an individual’s credit score, which can make it more difficult to obtain credit in the future.

Employment: Some employers may view bankruptcy negatively and may be hesitant to hire individuals who have filed for bankruptcy.

Housing: Some landlords may also view bankruptcy negatively and may be hesitant to rent to individuals who have filed for bankruptcy.

Rebuilding Credit After Bankruptcy

Rebuilding credit after bankruptcy is a crucial step towards regaining financial stability and establishing a solid foundation for the future. While bankruptcy may have a negative impact on credit scores and reports, it is important to remember that it is not the end of one’s creditworthiness. With time, responsible financial management, and strategic planning, individuals can rebuild their credit and work towards achieving a healthier financial standing. In this section, we will explore the importance of credit rebuilding, strategies for rebuilding credit after bankruptcy, and steps to monitor and improve creditworthiness.

Importance of Credit Rebuilding Rebuilding credit after bankruptcy is essential for several reasons. A good credit score and credit history are crucial for accessing credit in the future, such as obtaining loans, securing favorable interest rates, renting an apartment, or even applying for certain jobs. Rebuilding credit demonstrates financial responsibility and the ability to manage credit effectively. While it may take time and effort, the rewards of rebuilding credit are worth the investment.

Obtaining a Secured Credit Card One of the most effective strategies for rebuilding credit after bankruptcy is obtaining a secured credit card. A secured credit card requires a cash deposit as collateral, which serves as the credit limit. By using the secured credit card responsibly and making timely payments, individuals can demonstrate their ability to manage credit and establish a positive credit history. Over time, responsible use of a secured credit card can help improve credit scores and increase creditworthiness.

Making Timely Payments and Managing Credit Responsibly Timely payment of bills and debts is crucial for credit rebuilding. By making all payments on time, individuals establish a positive payment history, which accounts for a significant portion of credit scores. Setting up automatic payments or reminders can help ensure that payments are made promptly. Additionally, it is important to manage credit responsibly by keeping credit card balances low, avoiding excessive debt, and using credit sparingly.

Monitoring Credit Reports and Disputing Inaccuracies Regularly monitoring credit reports is essential for identifying and addressing any inaccuracies or errors that may negatively impact credit scores. It is recommended to obtain a free copy of the credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. Reviewing the reports for any discrepancies and promptly disputing them can help maintain accurate credit information and prevent any unwarranted negative impact on credit scores.

Reestablishing Creditworthiness Rebuilding credit after bankruptcy is a gradual process that requires consistent effort. Along with responsible credit card use and timely payments, there are other steps individuals can take to reestablish creditworthiness. These steps include:

Diversifying Credit: Applying for different types of credit, such as a car loan or a small personal loan, can help demonstrate the ability to manage various types of credit responsibly.

Becoming an Authorized User: Becoming an authorized user on someone else’s credit card account, such as a family member or a close friend, can help establish a positive credit history. However, it is crucial to ensure that the primary account holder has a good credit history and makes timely payments.

Seeking Credit-Building Programs: Some financial institutions and credit unions offer credit-building programs specifically designed for individuals looking to rebuild credit after bankruptcy. These programs may provide secured credit cards or installment loans with manageable terms to help individuals establish creditworthiness.

Rebuilding credit after bankruptcy requires time, patience, and disciplined financial management. It is important to remember that credit rebuilding is a gradual process and that results may not be immediate. By consistently implementing responsible credit practices, monitoring credit reports, and staying committed to financial goals, individuals can rebuild their credit and work towards achieving a healthier financial future.

Impact on Existing Loans and Mortgages

When filing for bankruptcy, individuals may be concerned about the impact it will have on their existing loans and mortgages. The treatment of these debts in bankruptcy varies depending on the bankruptcy chapter chosen and the specific circumstances of the case. In this section, we will explore the implications of bankruptcy on secured debts, options for keeping or surrendering assets, reaffirmation agreements, and considerations related to foreclosure and repossession.

Treatment of Secured Debts in Bankruptcy Secured debts are those that are backed by collateral, such as a house, car, or other valuable assets. In bankruptcy, secured debts are treated differently than unsecured debts. The treatment of secured debts depends on the bankruptcy chapter chosen:

a. Chapter 7 Bankruptcy: In Chapter 7 bankruptcy, individuals have the option to either reaffirm the debt, redeem the collateral, or surrender the collateral. Reaffirming the debt means agreeing to continue making payments on the debt and keeping the collateral. Redeeming the collateral involves paying the creditor the fair market value of the asset in a lump sum. Surrendering the collateral means returning it to the creditor, discharging the debt associated with it.

b. Chapter 13 Bankruptcy: In Chapter 13 bankruptcy, individuals have the opportunity to catch up on missed payments on secured debts through the repayment plan. This allows them to keep their assets, such as a home or car, by making regular payments as outlined in the plan.

It is important to consult with a bankruptcy attorney to understand the specific treatment of secured debts in your bankruptcy case and explore the best options for your situation.

Options for Keeping or Surrendering Assets When dealing with secured debts in bankruptcy, individuals generally have the option to either keep or surrender the assets associated with those debts. The decision depends on various factors, including the value of the asset, the ability to make future payments, and the desire to retain the asset.

If an individual wishes to keep the asset, such as a home or car, they may need to reaffirm the debt or propose a repayment plan in Chapter 13 bankruptcy to catch up on missed payments. This allows them to retain ownership and continue making regular payments according to the agreed-upon terms.

However, if individuals are unable or unwilling to continue making payments on the asset, surrendering the collateral is an option. Surrendering the collateral means returning it to the creditor, discharging the associated debt, and relieving oneself of the financial responsibility.

It is important to carefully evaluate the financial implications and long-term consequences of keeping or surrendering assets in consultation with a bankruptcy attorney.

Reaffirmation Agreements and Their Implications A reaffirmation agreement is a legal contract between the debtor and the creditor that allows the debtor to continue making payments on a particular debt despite the bankruptcy discharge. By reaffirming the debt, individuals reestablish their personal liability on the debt, effectively excluding it from the bankruptcy.

Reaffirmation agreements are often used for secured debts, such as car loans or mortgages, when individuals wish to retain the asset associated with the debt. It is important to consider the implications of reaffirmation agreements carefully. By reaffirming a debt, individuals remain personally liable for it, even after the bankruptcy discharge. If they default on the reaffirmed debt in the future, they could be subject to collection actions and potential legal consequences.

It is crucial to consult with a bankruptcy attorney to assess the risks and benefits of reaffirmation agreements, ensuring they align with your long-term financial goals and capabilities.

Foreclosure and Repossession Considerations Bankruptcy provides temporary relief from foreclosure and repossession actions through the automatic stay. The automatic stay halts these actions, providing individuals with time to assess their options and work towards resolving their financial difficulties.

In Chapter 7 bankruptcy, if individuals are unable to catch up on missed mortgage or car loan payments, the lender may eventually proceed with foreclosure or repossession. However, in Chapter 13 bankruptcy, individuals have the opportunity to propose a repayment plan to catch up on missed payments and prevent foreclosure or repossession.

It is crucial to work closely with a bankruptcy attorney to explore all available options to address foreclosure or repossession concerns and ensure the best possible outcome for your specific situation.

Bankruptcy and Your Assets

One concern individuals may have when filing for bankruptcy is how it will affect their assets. While bankruptcy may require individuals to sell some of their assets to repay creditors, many assets are exempt from bankruptcy. Exempt assets may include:

Homestead Exemption: Individuals may be able to exempt their home from bankruptcy, depending on the state where they reside and the equity they have in their home.

Personal Property: Individuals may be able to exempt personal property, such as clothing, furniture, and household goods, up to a certain dollar amount.

Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, may be exempt from bankruptcy.

Trustee after filing bankruptcy

When an individual or business files for bankruptcy, a trustee is typically assigned to the case. The trustee’s role is to oversee the bankruptcy process and ensure that the debtor’s assets are used to pay off as much of the outstanding debt as possible.

The trustee will review the debtor’s financial documents, collect and sell any non-exempt assets, and distribute the proceeds to the creditors according to the bankruptcy plan. The trustee may also preside over meetings with the creditors and the debtor to discuss the bankruptcy case and answer any questions. It is important for individuals and businesses to work closely with their trustee throughout the bankruptcy process to ensure that the case proceeds smoothly and all necessary steps are taken to achieve a successful outcome.

Credit Score

How soon will my credit card score improve? After filing for bankruptcy, it can take time for an individual’s credit score to improve. The length of time can depend on several factors, including the type of bankruptcy filed and the individual’s efforts to rebuild credit. Chapter 7 bankruptcy can stay on a credit report for up to 10 years, while Chapter 13 bankruptcy can remain on a credit report for up to 7 years. The impact of bankruptcy on a credit score can diminish over time. To improve a credit score after bankruptcy, individuals can take steps such as paying bills on time, monitoring credit reports for accuracy, and applying for a secured credit card or a credit-builder loan. It is also important to avoid taking on more debt than can be managed and to work with a credit counselor or financial advisor to develop a plan for rebuilding credit. With patience and consistent effort, it is possible to rebuild credit after bankruptcy and achieve a more positive credit score over time.

Buying a house after filing bankruptcy

The length of time an individual will need to wait to buy a house after filing for bankruptcy can depend on several factors, including the type of bankruptcy filed, the individual’s credit history, and the specific requirements of the mortgage lender.

For individuals who have filed for Chapter 7 bankruptcy, they may need to wait at least two years from the discharge date to qualify for an FHA loan and up to four years to qualify for a conventional loan. For individuals who have filed for Chapter 13 bankruptcy, they may be able to qualify for an FHA loan one year after filing and making timely payments on their debts under a court-approved repayment plan. However, they may need to wait up to two years to qualify for a conventional loan.

It is important to note that even after the waiting period has passed, the individual’s credit history and financial situation will still be considered by the mortgage lender. It may be helpful to work with a financial advisor or credit counselor to improve credit scores and financial standing before applying for a mortgage after bankruptcy.

Dealing with emotional effects after filing for bankruptcy

It is well-known that filing for bankruptcy can have emotional effects on individuals who go through the process.

For some individuals, filing for bankruptcy can be a difficult and stressful experience, as it may feel like a personal failure or a loss of control over their finances. It can also be a source of embarrassment or shame, especially if there is a social stigma attached to filing for bankruptcy.

Additionally, filing for bankruptcy can bring about feelings of uncertainty and anxiety about the future, as it may involve giving up assets or going through a court-mandated repayment plan. The process can also be emotionally draining and time-consuming, as it requires a significant amount of paperwork, meetings with creditors, and court appearances.

It is important for individuals who are considering filing for bankruptcy to be aware of these potential emotional effects and to seek support from loved ones or professional counselors if needed. It can also be helpful to focus on the positive aspects of the bankruptcy process, such as the opportunity to start fresh and rebuild financial stability.

More FAQs:

Will all my debts be eliminated in bankruptcy? No, some debts may not be eliminated in bankruptcy, such as student loans, taxes, and child support.

How long will bankruptcy stay on my credit report? Bankruptcy can stay on a credit report for up to 10 years, depending on the type of bankruptcy filed.

Can I file for bankruptcy multiple times? Yes, individuals and businesses can file for bankruptcy multiple times, but there are limitations on how often and when they can file.

Can I keep my car and house after filing for bankruptcy? It depends on the type of bankruptcy and the amount of equity individuals have in their car or house.

Can bankruptcy stop foreclosure or repossession? Yes, an automatic stay goes into effect when individuals file for bankruptcy, which can temporarily stop foreclosure or repossession proceedings.

Conclusion

In conclusion, filing for bankruptcy can be a difficult decision to make, but it can provide a fresh financial start for those struggling with overwhelming debt. Understanding the bankruptcy process and taking steps to rebuild credit and finances can help individuals and businesses move forward after bankruptcy. While there may be potential challenges after filing for bankruptcy, with time and effort, it is possible to rebuild and improve financial standing.

Further reading: